homesy5280 blog

HOW TO CHOOSE THE BEST MORTGAGE FOR YOU

The Six Main Types of Mortgages

Not all mortgage products are created equal. Some have more-stringent guidelines than others. Some lenders might require a 20% down payment, while others require as little as 3% of the home’s purchase price. To qualify for some types of loans, you need pristine credit. Others are geared toward borrowers with less-than-stellar credit. The U.S. government isn’t a lender, but it does guarantee certain types of loans that meet stringent eligibility requirements for income, loan limits and geographic areas. Here’s a rundown of various possible mortgage loans.

Conventional Mortgages

A conventional loan is a loan that is not backed by the federal government. Borrowers with good credit, stable employment and income histories, and the ability to make a 3% down payment can usually qualify for a conventional loan backed by Fannie Mae or Freddie Mac, two government-sponsored enterprises that buy and sell most conventional mortgages in the United States. To avoid needing private mortgage insurance (PMI)., borrowers generally need to make a 20% down payment. Some lenders also offer conventional loans with low down payment requirements and no private mortgage insurance (PMI).

Conforming Mortgage Loans

Conforming loans are bound by maximum loan limits set by the federal government. These limits vary by geographic area. For 2019 the Federal Housing Finance Agency set the baseline conforming loan limit at $484,350 for one-unit properties. However, FHFA sets a higher maximum loan limit of $726,525 (150% of the baseline limit) in certain parts of the country (think New York City or San Francisco, for example). That’s because home prices in these high-cost areas exceed the baseline loan limit by at least 115% or more.

Nonconforming Mortgage Loans

Nonconforming loans generally can’t be sold or bought by Fannie Mae and Freddie Mac, due to the loan amount or underwriting guidelines. Jumbo loans are the most common type of nonconforming loans. They’re called “jumbo” because the loan amounts typically exceed conforming loan limits. These types of loans are riskier to a lender, so borrowers typically must show larger cash reserves, make a down payment of 10% to 20% (or more), and have strong credit.

Government-Insured FHA Loans

Low-to-moderate-income buyers purchasing a house for the first time typically turn to loans insured by the Federal Housing Administration when they can’t qualify for a conventional loan. Borrowers can put down as little as 3.5% of the home’s purchase price. FHA loans have more-relaxed credit-score requirements than conventional loans. However, the FHA doesn’t directly lend money; it guarantees loans by FHA-approved lenders. One drawback of FHA loans: All borrowers pay an upfront and annual mortgage insurance premium (MIP)—a type of mortgage insurance that protects the lender from borrower default—for the loan’s lifetime.

FHA loans are best for low-to-moderate–income borrowers who can’t qualify for a conventional loan product or anyone who cannot afford a significant down payment. FHA loans allow a FICO score as low as 500 to qualify for a 10% down payment— and as low as 580 to qualify for a 3.5% down payment.

Government-Insured VA Loans

The U.S. Department of Veterans Affairs guarantees homebuyer loans for qualified military service members, veterans, and their spouses. Borrowers can finance 100% of the loan amount with no required down payment. Other benefits include a cap on closing costs (which may be paid by the seller), no broker fees, and no MIP. VA loans do require a “funding fee,” a percentage of the loan amount that helps offset the cost to taxpayers. The funding fee varies depending on your military service category and loan amount. The following service members do not have to pay the funding fee:

Veterans receiving VA benefits for a service-related disability

Veterans who would be entitled to VA compensation for a service-related disability if they didn’t receive retirement or active duty pay

Surviving spouses of veterans who died in service or from a service-related disability

VA loans are best for eligible active military personnel or veterans and their spouses who want highly competitive terms and a mortgage product tailored to their financial needs.

Government-Insured USDA Loans

The U.S. Department of Agriculture guarantees loans to help make homeownership possible for low-income buyers in rural areas nationwide. These loans require little to no money down for qualified borrowers—as long as properties meet the USDA’s eligibility rules.

USDA loans are best for homebuyers in eligible rural areas who have lower incomes, little money saved for a down payment, and can’t otherwise qualify for a conventional loan product.

Visit our Facebook page and join the discussion!

https://www.facebook.com/homesy5280/

Click on the link below to see more information.

https://www.investopedia.com/mortgage/mortgage-guide/how-to-choose-best-mortgage/

homesy5280 blog

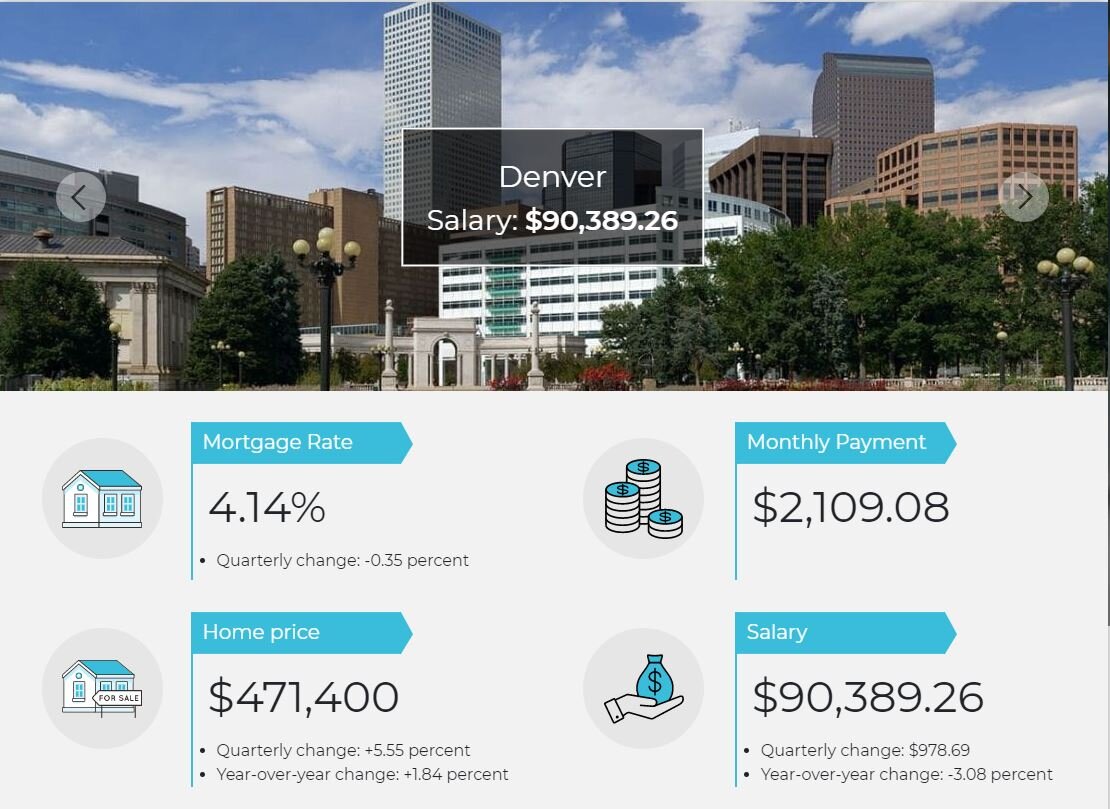

How Much Income You Need to Afford the Average Home in Every State in 2019

The housing market has not only recovered its pre-recession levels, but some observers are actually starting to worry about yet another housing bubble. Housing prices are on the rise, thanks in large part to extremely tight inventory, so it’s worth asking: are potential home buyers getting priced out of the market? The answer depends on where they live and how much money they make.

Relative to the first quarter of the year, when median prices of a homes sold tend to be at their lowest, the median price of homes sold in the second quarter rebounded smartly; 21 markets posted quarter-to-quarter double digit gains in median home prices, and those increases were more than sufficient to offset the affordability help that lower mortgage rates provided. That's the "bad news" segment, as on a quarterly basis only 7 markets saw a combination of smaller price increases and lower mortgage rates allow the required salary to decline.

It's worth noting that mortgage rates have again been lower to start the third quarter, which typically sees slowing home sales as the typical "homebuying season" winds down. Lower mortgage rates may increase demand a bit, and increased demand for homes in turn will tend to lift home prices. That said, and given the seasonal aspect, we could see diminishing price gains and lower mortgage rates improving affordability somewhat more as the summer comes to a close and the even-slower fall season begins.

Visit our Facebook page and join the discussion to see if locals agree with this new statistic or not!

https://www.facebook.com/homesy5280/

Click on the link below to see the national data of all 50 metros across the nation.

https://www.hsh.com/finance/mortgage/salary-home-buying-25-cities.html#denver